Pleo: Building the future of Expense Management

Today, we announced that Kinnevik invests in Pleo’s latest, USD 200m financing round to further build on our >10x return on investment to date. Andreas Bernström, Senior Investment Director at Kinnevik, reflects on the journey since he first met the company and what’s next.

By: Andreas Bernström, Senior Investment Director at Kinnevik

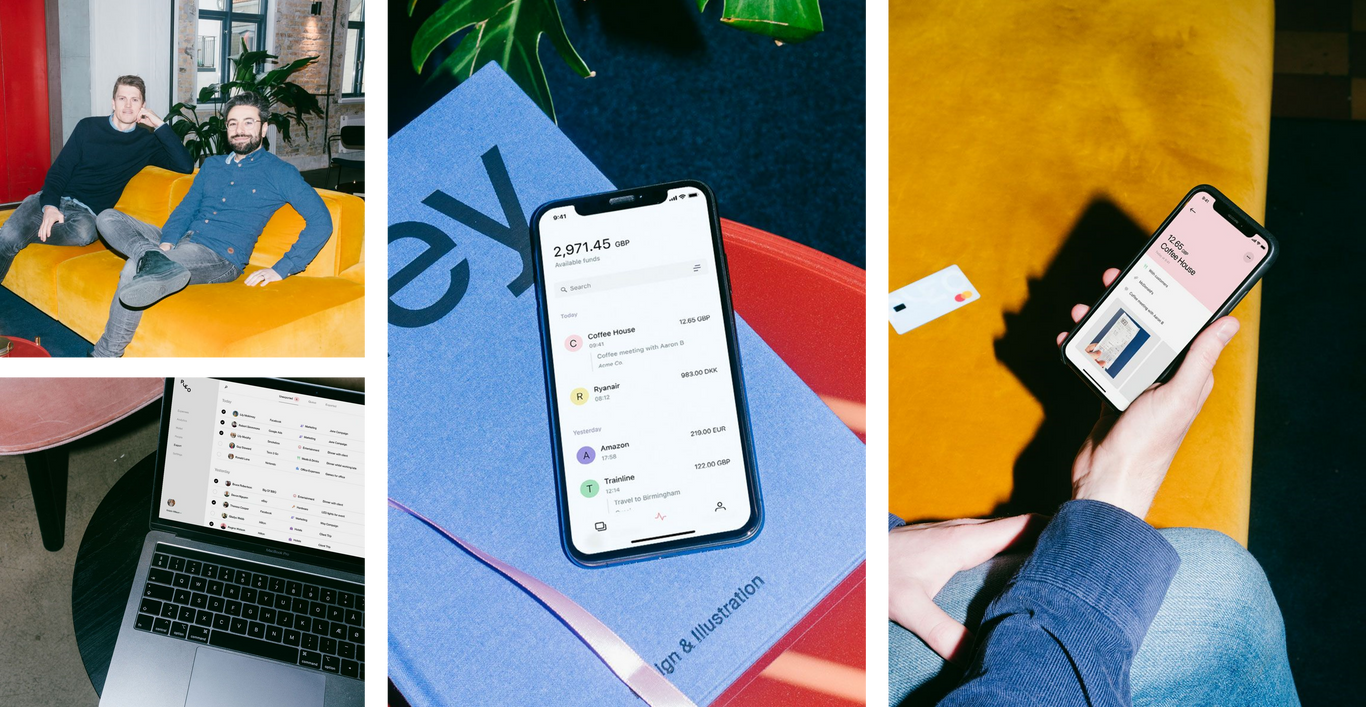

It has been almost four years since I was introduced to Jeppe, Nicco and the team at Pleo. It was apparent from the outset that the founding pair were a great complement of strategy, product, experience and execution. They were also focused on building something truly large, a sustainable company based on a new way of looking at an old industry - that of expense management.

The Vision and Our Original Thesis

Traditional expense management companies had focused on building and selling services to support finance teams, focusing on control and authorisation. Pleo had a different view - the major pain points were with employees, who saw expenses as agonising friction - time consuming, inefficient and retroactive. On many occasions, employees used their own cards and asked the company to reimburse them rather than go through the complications of internal systems. The system was broken and Pleo had a fix – we were excited to lead their Series A.

Pleo went about building a service to dramatically improve these challenges and to turn expenses in to a simple, elegant and easy-to-use experience on the back of a physical and digital card. The service allowed for real-time notifications when a card was used, the ability to take photos of receipts in the Pleo app, and automatic categorisation of all purchases. As expected, employees loved it. What was more surprising and exciting is that the finance team loved it even more. With time, the Pleo service has expanded to manage invoices, out-of-pocket, mileage and VAT, whilst tailoring these services to the nuances of each new market.

The Execution and the Potential for the Future

Fast forward to today and Pleo have not only delivered their vision of simplifying expenses, but have also expanded the product to encompass nearly all company spend - including processing and paying invoices. They now enable SMBs to have a smooth distributed spending solution empowering their staff - while staying in control and allowing clients track and optimise all company spend in real time.

They do all of this while seamlessly integrating with accounting tools such as Xero and Quickbooks - both improving administrative ease and increasing stickiness of the platform. Over time, there is further scope to build out this API-led approach given Pleo’s birds-eye view of spend.

Pleo today work with over 20,000 companies and processes annualised spend of over $1bn. The company has an average NPS of over 60, a Trustpilot rating of 5* as well as 5* ratings on Xero, G2 and Capterra.

The wealth of data it has access to, customer love and lack of innovation from incumbents mean that Pleo’s addressable market and ambitions will extend well beyond expense management towards offering a holistic suite of financial tools to clients.

Their success is as always a combination of many things, but I’d like to highlight three key areas. Firstly, a relentless focus on product innovation to ensure not only product-market-fit, but to delight their users. Secondly, incredible execution from marketing, to automated onboarding and go-to-market. Lastly and potentially most importantly, the founders have a true commitment and focus on their own staff and company culture which is reflected in their very strong Glassdooor ratings for company, CEO and diversity/inclusion (4.4*, 5.0*, 4.6*).

Our Reflections and Learnings

We see a broad trend towards “consumerisation of enterprise” or companies adopting consumer-like solutions for business use. For too long, there were forced boundaries between tools individuals used as consumers - that prioritised user experience - and tools they used as employees - that prioritised control and security. As more organisations hand back “power to people” and create more autonomy, the pendulum will swing towards “B2C2B” solutions like Zoom or Slack or Pleo or TravelPerk. Such tools enable simple self-serve onboarding for individual users, who then become product advocates internally and allow these product-led companies to have conversations with procurement teams once a significant user base has already developed within the company.

We also see a self-reinforcing flywheel where the best companies operate in a boundless TAM, attract the best talent, build the best product and secure the strongest balance sheet. The combined effect of this flywheel is to create larger outcomes than were ever previously imagined possible. Kinnevik led Pleo’s series A but have participated at-or-above pro-rata in their series B and C and continue to do so now in their series C extension led by Coatue and Alkeon. Kinnevik continues to believe that Pleo have the opportunity to be an outright winner in this large and growing market and it’s exciting to see we are not alone and humbling to have so many strong partners alongside us - such as Bain Capital, Thrive Capital, Stripes and Creandum. I greatly look forward to supporting the company going forward.