Sound Governance Structures

Sound corporate governance structures form the basis of Kinnevik’s sustainability efforts. We work actively to uphold the highest ethical standards, compliance and business conduct, both on a Kinnevik level and in relation to our portfolio.

Implementing Sound Governance Structures in Our Portfolio

Many of the companies in our portfolio are in the early stages of their operational and sustainability development, and im- plementing sound business conduct structures is central to the long-term success of these businesses. This work is part of a broader effort to create holistic and bespoke ESG strategies to enable sustainable growth.

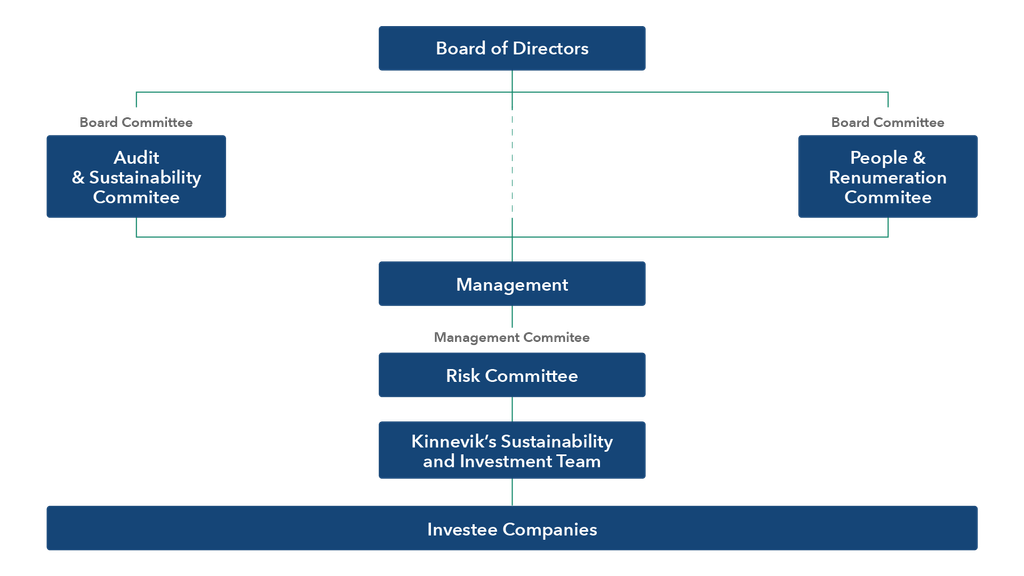

Governance Structures at Kinnevik

Kinnevik’s Board of Directors is responsible for our overall strategy, including how sustainability is an integrated part of our value creation, and is well informed about Kinnevik’s policies and procedures. Further, the Board of Directors is specifically responsible for identifying risks and opportunities related to sustainability, including climate change, that may impact Kinnevik, our portfolio and strategy, and for defining appropriate guidelines to govern Kinnevik’s conduct in society. This is embedded in the work and delegation procedures of the Board of Directors.

Overview of Kinnevik’s sustainability & governance organisation

Key Policies

Code of Conduct

All employees, representatives of Kinnevik and third parties engaged with Kinnevik are expected to fully comply with our Code of Conduct. Kinnevik has an onboarding process for new employees that introduces them to the Code of Conduct, which includes anti-corruption, anti-bribery and business ethics, and to other key policies and procedures. In addition, Kinnevik conducts mandatory annual Code of Conduct training for all employees. The Code of Conduct is shared with all relevant suppliers on a yearly basis.

Sustainability Policy

In the Sustainability Policy, we outline Kinnevik’s expectations in relation to our investee companies’ sustainability performance.

Lobbying Policy

Kinnevik’s policy is to actively engage in open dialogues with local governments, authorities and key policy makers. The purpose of such dialogues is to contribute to and improve the policy landscape and society as a whole. Among other things, Kinnevik participates in public consultations in areas of importance to Kinnevik and our portfolio companies.

Tax policy

Kinnevik works actively with responsible tax and Kinnevik shall maintain the highest standards of tax compliance and all tax affairs shall be managed in full compliance with local law and international guidelines.

Whistleblower Policy

Diverisity & Inclusion

Kinnevik’s policies, processes and rules relating to diversity and inclusion are outlined in Kinnevik’s corporate policies, including the Employee Handbook, Talent Management Policy and Work Environment Handbook. Read more about the key aspects of diversity & inclusion at Kinnevik