We Are Active Owners

Kinnevik has influence over our investee companies through capital allocation, Board representation and ongoing operational support. We work in close collaboration with our companies in setting bold strategic visions and targets for building long-term sustainable and successful businesses.

An Integral Part of Our Value Creation

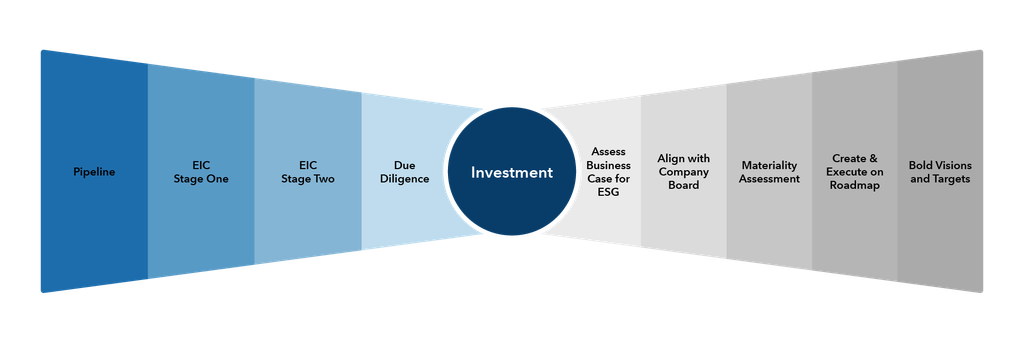

Kinnevik’s sustainability team is represented at each stage of the investment process, and only companies that fit our investment ethos and share our values are brought to the Executive Investment Committee (”EIC”). In connection with the EIC, we assess a company’s sustainability structures and progress across environmental, social and governance aspects, its positive and negative impacts in accordance with the Impact Management Norms, its sustainability risks and opportunities, and its alignment with a low-carbon future.

After investment, we have a structured and bespoke approach to sustainability. We support the companies with a double materiality analysis to identify their key sustainability topics, to align priorities internally and to determine how sustainability can add business value. As appropriate, we also help articulate and measure their positive impact on the world. This lays the foundation for a holistic sustainability strategy including visions, targets and a concrete roadmap.

Overview of Kinnevik’s investment process and ESG engagement with our companies