Cityblock and the US healthcare system

In July 2025, the US Congress passed legislation which carries cuts to Medicaid, including reduced federal state funding and mandatory work requirements. While Cityblock partly relies on Medicaid, their mission to provide cost-effective, preventative care for underserved populations is very much aligned with the administration’s focus on improving efficiency in healthcare delivery. We believe Cityblock offers a unique value proposition to payers and the entire US healthcare system, and that the company's underlying market is set to grow significantly in the coming decade.

Huge addressable market and an attractive value proposition

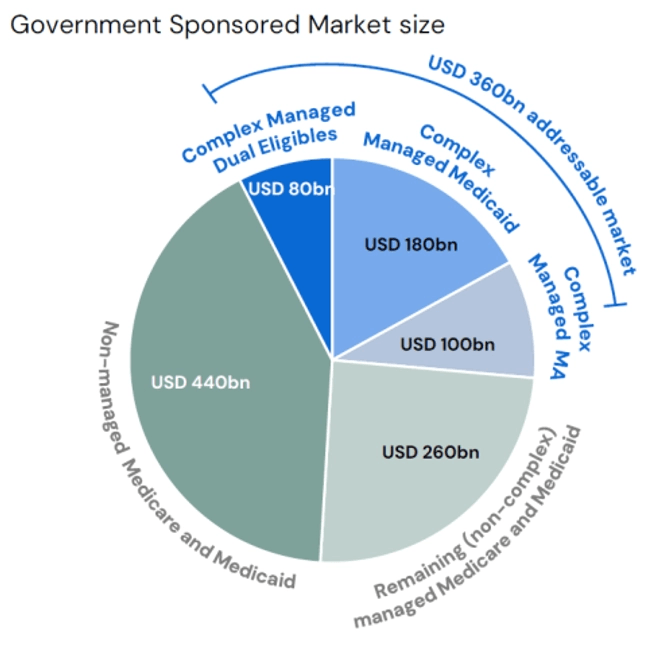

Cityblock is a tech-enabled, value-based healthcare provider focused on underserved populations in the US. Cityblock partners with health insurers in risk sharing arrangements to manage the most complex, underserved, and marginalized patients covered by government health programs with particular focus on Medicaid and the so called “dual beneficiaries”. Cityblock is assigned patients by insurers and paid a monthly fee per member to be responsible for their care. Through its unique community-centred care model, underpinned by a proprietary tech platform, Cityblock improves health outcomes while lowering medical claims costs. This drives financial savings to payers, who share a portion of the savings with Cityblock.

The company’s tailwinds are strong. The US population is aging, more people are becoming eligible for government programs, and the movement towards value-based care continues. About 40 percent of US healthcare spend is now in value-based arrangements – double compared to five years ago. Cityblock offers a unique value proposition to payers by being able to care for its most complex populations in an effective and cost-efficient way. The company is the clear leader in the Medicaid and dual beneficiary value-based care space with leading engagement scores, health outcomes and ROI.

US healthcare policy changes

A significant share of the national healthcare budget in the US is spent on Medicaid, Medicare, and dual beneficiaries. Medicaid serves low-income individuals, Medicare serves the elderly and disabled, while dual-eligible beneficiaries are those who qualify for both Medicare and Medicaid. Given the rise in aging population, the individuals captured by these programs are rapidly expanding, with the number of dual beneficiaries increasing at a nine percent CAGR. Under the Affordable Care Act, Medicaid expansion has extended coverage to millions of uninsured Americans, democratizing access to care, and reducing the financial burden on low-income families in need of care. However, the rising cost of healthcare has been an increasing concern for the government.

In July 2025, the US Congress passed legislation which carries an estimated USD 1 trillion in Medicaid cuts, eliminating at least 10.5 million people from the programs by 2034. This marks one of the most aggressive cost-containment efforts for Medicaid in decades.

Central to the legislation is a transition to capped funding models, where states receive fixed amounts of money per beneficiary, rather than the federal government covering an open-ended share of costs. This leads to fewer resources for healthcare services. In parallel, the introduction of work requirements to qualify for Medicaid will result in increased disenrollment and further limit access to care.

Additionally, healthcare providers and value-based care companies, particularly those relying on Medicaid patients, will face higher operational costs due to tariffs on imported medical goods (such as equipment, supplies or drugs), which puts a strain on their already thin margins. Value-based care providers specifically might have to choose between absorbing the cost or reducing access to certain treatments with increased costs, which undermines patient outcomes and financial targets.

These dynamics are forcing US healthcare companies to rethink sourcing, slow growth plans, and prepare for a structurally more expensive and fragmented healthcare landscape.

However, the mandate of the current government remains largely focused on reducing inefficiency and cutting waste, which actually strengthens the importance of value-based care models. Value-based care, in its essence, focuses on improving patient outcomes while reducing costs, which aligns with the administration’s goals. Although some government-led pilot programs for value-based care have been cancelled, this shift signals a refocusing on proven models that have demonstrated cost savings and efficiency. Value-based care companies must now pivot toward partnerships with private payers or adapt their models to demonstrate clear cost containment.

For companies like Cityblock, which is already contracted with the majority of private national insurers and is showing strong results in managing care for underserved populations, this shift presents an opportunity. Further, their community and in-home focused care model shifts care volume away from expensive facilities and away from overreliance on medical supplies towards preventative care.

The bottom line

While cuts to government healthcare programs reduce the overall market size for value-based care, Cityblock remains well-positioned to thrive. Their mission to provide cost-effective, preventative care for underserved populations is very much aligned with the administration’s focus on improving efficiency in healthcare delivery. The company today captures a small fraction of the addressable market in Medicaid and Dual Eligibles, leaving substantial room for growth despite the changes in reimbursement. We continue to monitor policy developments closely and expect some friction as the US healthcare market adapts, however, we remain firm in our conviction in Cityblock’s ability to create long-term value. Cityblock significantly improves outcomes and reduces cost for health insurers in the government sponsored healthcare market, which continues to be a top priority for the current administration.

Medicaid expansion, as allowed under the Affordable Care Act (ACA) of 2010, was designed to extend Medicaid coverage to nearly all adults with incomes up to 138 percent of the federal poverty level, which is about USD 20,120 per year for an individual in 2024. Prior to the ACA, Medicaid was mostly limited to low-income children, pregnant women, parents, elderly individuals, and people with disabilities. Under the expansion, adults without dependent children can qualify based solely on income. The size of Medicaid expansion is around 20-35 percent of Medicaid and Medicaid expansion combined. The Supreme Court ruled in 2012 that states can decide whether to expand Medicaid. As of 2024, 40 states (including D.C.) have expanded Medicaid, while 10 states have not.